Housing Assistance CT: Your Guide to Programs and Solutions, Connecticut Housing Crisis

Hey there! Let’s talk about something that’s been keeping Connecticut residents up at night – the housing situation. If you’ve been searching for housing assistance CT programs or just trying to figure out why finding an affordable place to live feels impossible here, you’re not alone. Connecticut’s housing crisis isn’t just some abstract policy issue; it’s affecting real people, real families, and real communities every single day.

Think of Connecticut’s housing market like that one friend we all have who’s perpetually overbooked – there’s just not enough to go around, and what is available costs way more than it should. But here’s the thing: understanding the problem is the first step toward finding solutions, and there are more resources and programs available than most people realize.

Table of Contents

Understanding Connecticut’s Deep-Rooted Housing Crisis

The Historical Rollercoaster That Got Us Here

Connecticut’s housing story reads like a financial thriller with more twists than a Netflix series. Let’s rewind the clock and see how we ended up in this mess – because trust me, it didn’t happen overnight.

The Early Days: When Things Were “Simpler”

Back in the roaring 1920s, Connecticut was riding high on a housing boom that felt like it could last forever. People were making good money, credit was easy to get, and construction was booming. Sound familiar? Yeah, that’s because we’ve seen this movie before – several times.

But by the late 1920s, reality came knocking hard. The housing bubble burst around the same time as the stock market crash in 1929, and suddenly those inflated home prices came crashing down. By 1940, the median home value had bottomed out at about $4,615, which might sound like a steal until you realize that’s roughly $48,000 in today’s money. Still not exactly pocket change for most folks back then.

The government stepped in with the Federal Housing Administration (FHA) in 1934, trying to make homeownership more accessible. It was one of those “Action Over Exclusion” moments where policymakers realized they needed to do something concrete rather than just hope the market would fix itself.

Post-War Boom and the Suburban Dream

After World War II, Connecticut faced a housing shortage that would make today’s crisis look like child’s play. Veterans were coming home, the workforce was growing, and suddenly everyone needed a place to live. The 1944 GI Bill sparked a massive housing boom, and Connecticut’s suburbs started expanding like crazy thanks to federally subsidized highways (hello, I-95 and I-84) and the fact that everyone was buying cars.

But here’s where things get interesting – even back in the late 1950s, affordability was becoming an issue. Cities like Stamford and Hartford were expanding public housing projects, but it was clear that keeping housing affordable was already becoming a challenge. By the 1960s, urban renewal programs were displacing low-income residents, and home prices in Connecticut grew by nearly 60% during that decade. Talk about foreshadowing our current problems!

The Wild Ride of the Late 20th Century

The 1970s brought economic turbulence with oil shocks and stagflation, but Baby Boomers were forming households and driving up housing demand. Here’s a fun fact that’ll make your head spin: Mortgage rates hit an all-time high of 16.6% by 1981. Can you imagine trying to buy a house with a 16% interest rate today? People would lose their minds!

Despite those crazy rates, prices kept climbing. The median Connecticut home value reached $129,900 in 1980 (adjusted to 2000 dollars). Meanwhile, many suburban towns were implementing exclusionary zoning regulations that basically said “no affordable housing allowed,” which definitely didn’t help the situation.

The 1980s brought another housing boom, especially in wealthy areas like Fairfield County, fueled by falling interest rates and what economists politely call “speculative fervor” (translation: people were buying houses like they were Pokémon cards). By 1990, Connecticut’s median home value reached one of the highest in the nation at an inflation-adjusted $227,000.

But here’s where Connecticut tried something pretty innovative: the Affordable Housing Land Use Appeals Act of 1989. This law said to towns with less than 10% affordable housing, “Hey, you can’t use zoning to block affordable housing anymore.” It was another classic “Action Over Exclusion” approach, and by 2024, it had helped create over 8,500 long-term affordable units.

The 21st Century: New Bubbles, Same Problems

The early 2000s saw yet another housing boom, with prices jumping 50-60% higher by 2007 than they were in 2000. Then came 2008 – the financial crisis that reminded everyone that what goes up can come down. Connecticut home prices fell 20% or more from 2007 to 2012.

The 2010s brought slow recovery with modest price increases, but here’s the kicker: new construction was extremely low – we’re talking just a few thousand units per year, well below the rate at which new households were forming. It was like trying to fill a bathtub with the drain wide open.

By 2019, over half of renter households were cost-burdened, meaning they were spending more than 30% of their income on housing. Then COVID-19 happened, and remote work drove demand through the roof while mortgage rates hit historic lows. Connecticut home prices reached all-time highs by 2022, with a median of $430,000 – up about 30% in just two years.

Where We Stand Today: The 2025 Reality Check

Let’s talk numbers, because sometimes you need to see the data to understand how serious this is.

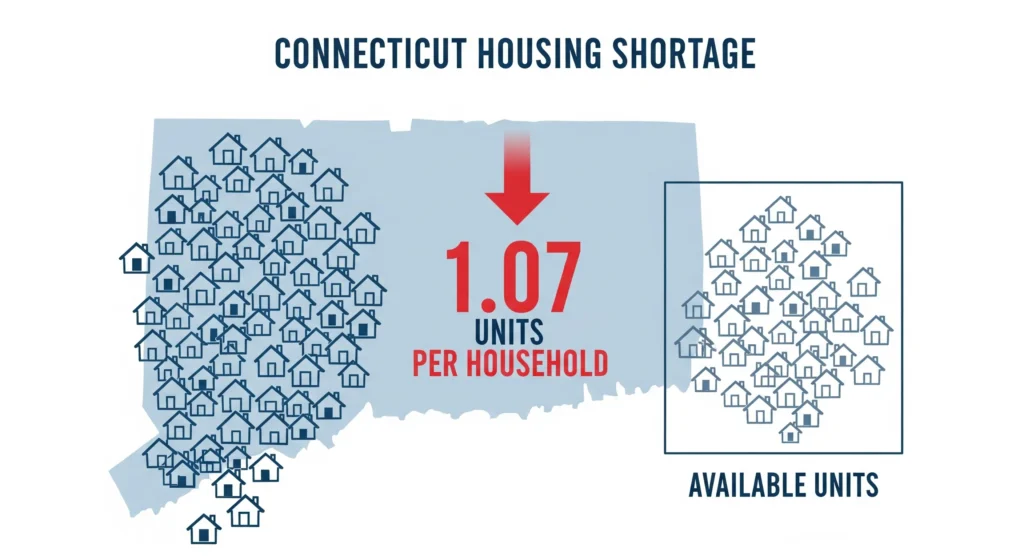

The Inventory Crisis

Connecticut currently faces what experts are calling an “urgent housing affordability crisis” with one of the nation’s most constrained housing markets. Here’s what that looks like in real terms:

- We have just 1.07 housing units per household, which means there’s virtually no buffer of extra homes (the US average is about 1.15)

- Our vacancy rate is only around 7%, when healthy markets typically see 10-12%

- For-sale inventory is near record lows with just 1-2 months of supply in many towns (a balanced market needs 5-6 months)

Fairfield and parts of Litchfield County have the most pronounced underproduction, but really, the shortage is statewide.

The Cost Burden Reality

The numbers here will make you want to cry, laugh, or maybe both:

- The median single-family home sale price in Connecticut is now in the mid-$400,000s, up 25-30% from 2020-2024

- Median rent for a 2-bedroom in Greater Hartford jumped from $1,200 in 2019 to over $1,500 in 2024

- About 33% of all Connecticut households are cost-burdened

- 15% of households are severely cost-burdened (spending more than half their income on housing)

- Over 80% of households earning below 50% of Area Median Income are cost-burdened

Here’s a reality check that hits hard: renters in Connecticut need to earn over $57,000 annually just to avoid spending more than a third of their income on a two-bedroom apartment. Meanwhile, average salaries in Connecticut range wildly from $24,800 (lowest) to $438,000 (highest) – and guess which end of that spectrum most people fall on?

The Human Cost

This isn’t just about numbers on a spreadsheet. For people in recovery from addiction, mental health challenges, or homelessness, affordable and stable housing isn’t just nice to have – it’s essential for rebuilding their lives. Organizations like Continuum of Care, Inc. understand that a lack of housing stability significantly increases the likelihood of relapse and other negative outcomes.

The state currently lacks an estimated 85,400 homes that are available and affordable to renters with extremely low incomes. That’s not a small gap – that’s a canyon.

Comprehensive Policy Responses and Initiatives for Housing Justice

Okay, so we’ve established that the situation is pretty dire. But here’s the good news: people are doing something about it. Let’s dive into the programs and initiatives that are working to address Connecticut’s housing assistance CT needs.

Federal Funding: The Big Picture

The American Rescue Plan Act (ARPA): A Recent Lifeline

The American Rescue Plan Act of 2021 was one of the most significant recent attempts to address the national housing crisis, and Connecticut got its share of the pie. The federal government gave Connecticut $1.5 billion in stimulus funding to help with pandemic recovery and community investments.

Here’s what’s cool about ARPA: it gave local officials flexibility to spend funds on things like rent and mortgage assistance, housing planning, energy efficiency improvements, homelessness assistance, and development or preservation of affordable housing. It was designed to be an “Action Over Exclusion” approach to getting help where it was needed most.

But here’s where it gets frustrating: despite all this available funding, Connecticut’s 169 municipalities budgeted only about 1% of their share for housing-related projects as of April 2024. Talk about leaving money on the table!

Bridgeport, which is home to Recovery Community Development, actually did step up and budgeted $5.5 million for rental assistance, home weatherization, new affordable housing, and support for transitional housing nonprofits. But Bridgeport’s approach seems to be more the exception than the rule.

Part of the problem is that Connecticut abolished county government back in 1960, which means responsibility for housing gets diffused among all these municipalities. Some local leaders don’t view housing as their responsibility, treating available funding like it’s “somebody else’s problem.” It’s classic bureaucratic buck-passing, and it’s not helping anyone who needs a place to live.

HUD Programs: The Steady Foundation

Connecticut is expecting about $150 million in HUD funding over the 2025-2029 period through various programs:

- Community Development Block Grant (CDBG): About $69.48 million estimated

- HOME Investment Partnerships (HOME): Around $52.18 million estimated

- National Housing Trust Fund (HTF): Roughly $15.72 million estimated

- Emergency Solutions Grants (ESG): About $11.49 million estimated

- Housing Opportunities for Persons With HIV/AIDS (HOPWA): Around $1.44 million estimated

These programs provide a steady foundation, but as state officials note, inadequate federal funding remains a major obstacle to addressing the full scope of housing needs.

State-Level Strategy: Connecticut’s Game Plan

The 2025-2029 Consolidated Plan: Setting Bold Goals

Connecticut’s Consolidated Plan isn’t just a bureaucratic document – it’s a pretty ambitious roadmap for addressing the housing crisis. The Partnership for Strong Communities has been advocating for equitable change in Connecticut housing policy, guided by the principle that housing is a human right. That’s the kind of “Action Over Exclusion” thinking we need more of.

Here are the state’s quantifiable goals for 2025-2029, and they’re pretty impressive:

New Housing Development:

- Construct 15,500 new affordable rental units

- Support 5,000 new affordable homebuyer units

- Create 1,000 new affordable rental units specifically for people with special needs

Preservation and Rehabilitation:

- Rehabilitate 15,500 existing rental units

- Rehabilitate 450 owner-occupied homes

- Rehabilitate at least 5,000 units of existing public housing

- Remediate lead hazards in 500 housing units

Assistance and Support:

- Provide tenant-based rental assistance or rapid rehousing to 72,500 households

- Complete at least 5 public facilities or infrastructure projects benefiting low and moderate-income communities

How They’re Planning to Actually Do It

The state has outlined several strategies that go beyond just throwing money at the problem:

Expanding New Housing Supply: Using programs like HOME, HTF, and state programs like CHAMP and the Housing Trust Fund to finance new developments. It’s about creating sustainable funding streams, not just one-time fixes.

Preservation Efforts: Modernizing public housing through HUD’s Capital Fund and running homeowner rehabilitation programs. Sometimes it’s more cost-effective to fix what we have than to build from scratch.

Coordinated Support Services: Working with Continuums of Care (CoC) and Coordinated Access Networks (CANs) to provide comprehensive support. ESG funds support shelters, street outreach, and rehousing programs.

Zoning Reform: This is where things get interesting. The state is encouraging municipalities to adopt zoning regulations that promote diverse housing options and higher density. Recent legislative efforts around Accessory Dwelling Units (ADUs) and “Fair Share” housing frameworks are part of this conversation.

Here’s a sobering fact: Connecticut’s Zoning Atlas shows that over 80% of residential land is zoned for single-family homes only. That’s a lot of exclusionary zoning that needs to change.

Specialized Programs Making a Difference

Connecticut also contracts with organizations to provide specialized services. For example, AIDS Connecticut Inc. works specifically on HIV/AIDS housing policy, providing technical assistance, increasing public awareness, and ensuring quality housing access for clients living with HIV/AIDS.

These organizations do crucial work like developing yearly and five-year plans for HUD’s Connecticut Continuum of Care regions, assisting with HOPWA grants, and facilitating training for professionals. They also collaborate with the Coalition to End Homelessness on data collection and reporting.

Navigating Connecticut’s Rental Landscape: Know Your Rights

Let’s get practical for a minute. If you’re looking for housing assistance CT programs, or dealing with rental issues, you need to know your rights and responsibilities. Connecticut’s landlord-tenant laws are pretty tenant-friendly compared to some states, but only if you know how to use them.

What Landlords Must Do (And What They Can’t)

Landlord Responsibilities: The Non-Negotiables

Connecticut law is pretty clear about what landlords have to provide:

- A rental unit that meets local health and safety regulations (this isn’t optional)

- Repairs within 15 days of written notice (get everything in writing!)

- Reasonable notice before entering your place (generally 1-2 days, except for emergencies)

- A clean apartment when you move in

- Working plumbing and heating systems with hot and cold water

- Safe stairways, porches, floors, ceilings, and walls

- Good locks on doors and safe fire exits

- Compliance with weatherization standards if the property receives rental assistance

Landlord Rights: What They Can Do

Landlords can request and collect rent (obviously), deduct damage repairs from your security deposit if the damage is beyond normal wear and tear, and work to provide a safe and calm environment for all tenants.

Tenant Rights and Responsibilities: Your End of the Deal

Your Rights as a Tenant

- Live in a habitable property (this is huge – if your place is unsafe or uninhabitable, you have legal recourse)

- Seek housing without discrimination

- Request repairs and actually withhold rent if repairs aren’t made timely for issues that breach habitability

- Abandon the property if it becomes uninhabitable

Your Responsibilities as a Tenant

- Pay rent on time (seems obvious, but it’s legally important)

- Keep the property safe and in good condition

- Maintain a quiet environment for other tenants

- Follow the terms of your lease agreement

The Nitty-Gritty: Leases, Rent, and Security Deposits

Lease Agreements and Rent Laws

Here’s something interesting: in Connecticut, leases over one year must be in writing, but oral agreements are accepted for shorter terms. Still, written agreements are always recommended because they protect both parties.

Connecticut doesn’t have rent control laws, but cities and towns can establish Fair Rent Commissions to handle complaints and prevent excessive rent increases. Landlords can’t raise your rent during the lease term unless it’s specifically written into the lease, and no state law specifies how much notice they have to give for rent increases.

There’s a 9-day grace period before landlords can charge late fees for unpaid rent, but there’s no limit on how much they can charge for late fees. So read your lease carefully!

Security Deposit Rules: Know the Numbers

Connecticut’s security deposit laws are pretty specific:

- Landlords can charge up to two months’ rent for a security deposit

- For tenants over 62, the maximum is one month’s rent

- Cash payments require a receipt

- You earn interest on your deposit if you pay rent on time

- The deposit must be stored in an escrow account where it earns annual interest

- It must be returned within 30 days or 15 days after you provide a forwarding address, whichever is later

- If they don’t return it on time, you can sue for twice the deposit amount plus court costs

Eviction Laws: Serious Business

Connecticut strictly prohibits self-help evictions – landlords can’t just change the locks or throw your stuff out. They have to follow specific legal procedures with specific notice periods:

- Unpaid rent: 3-day notice to quit

- Lease violation: 15-day notice to comply or vacate (but if you repeat the violation within 6 months, they can give a 3-day notice to vacate with no second chance)

- End of lease term: 3-day notice to quit, but you get until the end of the normal rent period

- Illegal activity: 15-day unconditional notice to quit (no notice required if there’s a conviction for prostitution or illegal gambling)

Discrimination and Fair Housing: Action Over Exclusion

Connecticut takes housing discrimination seriously. Landlords can’t discriminate based on race, color, religion, sex, national origin, familial status, ancestry, marital status, age (except for minors), sexual orientation, gender identity or expression, legal source of income, veteran status, or disability.

They also can’t retaliate against you for exercising your legal rights, like reporting housing code violations or joining tenant organizations.

Required disclosures include information about lead-based paint in pre-1978 homes, contact information for property managers, security deposit details, fire sprinkler system status, and whether there are bed bugs in adjacent units.

Innovative Solutions for Connecticut’s Housing Future: The Modular Advantage

Now, let’s talk about something that could be a real game-changer for housing assistance CT programs: modular construction. This isn’t your grandfather’s prefab housing – this is high-tech, high-quality construction that could help solve Connecticut’s housing shortage faster and more affordably than traditional building methods.

What Is Modular Construction, Really?

Modular construction means building components or entire sections of homes in a factory, then transporting and assembling them on-site. Think of it like LEGO blocks, but for houses – and way more sophisticated.

The cool thing about modular construction is that it addresses several of Connecticut’s housing challenges at once. It’s faster, cheaper, creates jobs, and can produce a lot more housing units than traditional construction methods.

The Benefits That Could Transform Connecticut’s Housing Market

Speed: Getting People Housed Faster

This is where modular construction shines. It can speed up housing delivery by 30-50% because factory work can happen year-round while site preparation happens in parallel. We’re talking about homes delivered in 16 weeks instead of the usual timeline – that’s about 5 times faster than traditional construction.

Some factories can produce 500 units per year. To put that in perspective, if Connecticut had just a couple of these facilities running, we could make a serious dent in the housing shortage.

Cost Savings: Making Housing Actually Affordable

Modular construction can reduce construction costs by about 20% or more through economies of scale and bulk purchasing. For a $300,000 home, that’s a $60,000 savings. It also reduces material waste by up to 90%, which is both cost-effective and environmentally friendly.

These aren’t small savings – they’re the kind of cost reductions that could make housing affordable for working families.

Job Creation: Building the Economy While Building Homes

A single modular housing factory could create 50-150 direct jobs, with some plants expecting to employ 166 full-time workers. These are often decent-paying jobs – around $30 per hour in some cases – that don’t require a college degree but do provide good career prospects.

This kind of job creation diversifies Connecticut’s economy and strengthens the construction workforce pipeline. It’s an “Action Over Exclusion” approach to economic development that benefits everyone.

Environmental Benefits: Building Smarter, Not Just Faster

Modular construction isn’t just faster and cheaper – it’s also more sustainable:

- Up to 83% reduction in total waste weight

- Uses 67% less energy for construction

- Better quality control leads to more energy-efficient finished homes

- Enhanced durability against wind and seismic forces

- Speeds disaster rebuilding and makes it easier to incorporate green technologies

Addressing the Scale of the Problem

Here’s the big picture: a single factory producing 500 units per year could deliver 5,000 units in a decade. That would significantly contribute to Connecticut’s affordable housing goals while creating what experts call “housing surge capacity” – the ability to rapidly increase production when needed.

Overcoming the Skeptics

Some people hear “modular housing” and think “cheap” or “temporary,” but that’s not accurate. Modern modular housing is often higher quality than site-built homes because of factory precision and inspections. It’s being used successfully in expensive markets like New York City, Boston, and San Francisco.

The initial capital cost for setting up a modular facility is high, but the long-term financial and social benefits are strong, especially given Connecticut’s consistent demand for housing.

Future Outlook: What the Next 20 Years Could Look Like

Let’s talk about where Connecticut’s housing market is headed and what we need to do to get to a better place. Spoiler alert: it’s going to take sustained effort and some pretty significant changes to how we approach housing, but it’s achievable.

The Next 5 Years (2025-2030): Laying the Foundation

If Connecticut really commits to addressing the housing shortage, we need about 40,000 to 50,000 new housing units by 2030. That means quadrupling our current production rate – no small task, but not impossible with the right policies and funding.

Home prices will probably plateau or rise modestly (1-3% annually), which means the median home price could be 10-15% higher than 2025 levels. So if we’re at $400,000 now, we might be looking at $440,000-$460,000 by 2030.

Rental demand will probably remain strong, with rents potentially rising another 10% over the next five years. Our population is getting visibly older – about 20% of residents will be 65 or older, which increases the need for senior housing and accessible units.

The 10-Year Vision (2025-2035): Real Progress

With aggressive reforms, Connecticut could produce 80,000-100,000 units in a decade. That would be doubling our recent production rates, but it’s achievable with the right combination of policy changes, funding, and innovative approaches like modular construction.

The median home value could be 20-30% above 2025 levels in nominal terms, but if we’re producing enough housing, that increase would mainly reflect normal inflation rather than shortage-driven price increases.

Here’s something interesting that could happen: we might see a wave of housing turnover as Baby Boomers transition to senior housing or pass away, potentially freeing up single-family homes for younger families.

In the positive scenario, the market could improve significantly: vacancy rates could normalize to healthier levels, cost-burden rates could drop below 25%, and we’d have much more diverse housing types available throughout the state.

The 20-Year Goal (2025-2045): A Transformed Market

Over 20 years, Connecticut needs about 150,000+ new units to really resolve the supply issues. That’s an average of 7,500 units per year – ambitious, but not unrealistic if we maintain focus and funding.

Nominal prices will probably be about 50% higher than 2025 levels due to inflation alone, but if we build enough housing, rents could be relatively stable and affordable.

By 2045, intergenerational turnover will be fully underway. Connecticut’s overall population might decline slightly, but we’ll have more households due to smaller average household sizes. Housing will need to be more resilient to climate impacts – flood-proof, energy-independent, and built to last.

The Critical Gaps We Need to Fill

The Affordable Housing Gap

Connecticut lacks about 100,000 units of affordable housing for low- and moderate-income households. For every 100 extremely low-income renter households, only about 40 affordable and available units exist. That’s a massive shortage that requires sustained attention and resources.

The Accessibility Gap

Much of Connecticut’s older housing stock isn’t accessible for people with disabilities or limited mobility. With our aging population, this gap is only going to get worse unless we address it proactively.

The Workforce Housing Gap

There’s a shortage of “starter homes” for households earning 80%-120% of Area Median Income. These are the teachers, firefighters, nurses, and other essential workers who keep our communities running, but they’re being forced to live far from work or in cramped, expensive units.

Geographic and Racial Disparities

Affordable housing is concentrated in cities, while jobs and good schools are often in suburbs that lack housing options. Communities of color face higher rates of overcrowding and have less access to homeownership opportunities.

Strategies That Can Actually Work

The good news is that we know what works – it’s just a matter of having the political will and sustained funding to do it:

- Rapidly produce new affordable and mixed-income housing using programs like modular construction

- Preserve and rehabilitate existing affordable units rather than losing them to market pressures

- Reform zoning to allow more diverse housing types, especially in exclusionary suburban towns

- Increase rental assistance and vouchers to help people afford existing housing while we build more

- Invest in infrastructure to support higher housing density where it makes sense

- Expand homeownership programs for first-time buyers and create more moderately priced starter homes

- Strengthen protections for renters so people aren’t displaced by speculation or discrimination

Building a Foundation for Connecticut’s Future

Connecticut’s housing crisis is definitely a major challenge, but it’s also an opportunity. We can choose to keep doing things the way we always have – with predictably poor results – or we can embrace innovative, evidence-based solutions that work.

The housing assistance CT programs and policies outlined in the 2025-2029 Consolidated Plan are ambitious, but they’re also necessary. Modular construction, zoning reform, expanded rental assistance, and coordinated support services can make a real difference if we implement them consistently and adequately fund them.

Here’s the thing: housing isn’t just about having a roof over your head. It’s the foundation for everything else – stable employment, good education for kids, access to healthcare, community connections, and the opportunity to build wealth and security for the future.

Think of Connecticut’s housing market like a very old, complex plumbing system that was built piece by piece over a century. Some pipes are too small, some areas get too much pressure, and others barely get any flow at all. The housing crisis is like a significant water shortage across the system, with many homes unable to get enough water, and what little comes through is expensive.

The Consolidated Plan is like a master blueprint for a major system overhaul. It identifies where the leaks are, which pipes are too narrow (that’s the restrictive zoning), and where new lines are desperately needed. Modular housing factories are like high-efficiency, standardized pipe manufacturers that can quickly produce and deliver exactly the components needed to expand and repair the system on a massive scale, at lower cost, ensuring water – or in this case, housing – flows freely and affordably to everyone, everywhere it’s needed in the state.

The path forward requires collaborative effort from the government, private sector, and communities. It means choosing “Action Over Exclusion” – building housing instead of just talking about it, reforming zoning instead of protecting the status quo, and treating housing as a human right rather than just a commodity.

Connecticut has all the pieces needed to solve this crisis: federal funding, state programs, innovative technologies like modular construction, and organizations committed to housing justice. What we need now is the sustained political will to put all those pieces together and build the housing our communities desperately need.

The good news? We’ve solved big challenges before, and we can do it again. The housing crisis didn’t happen overnight, and it won’t be solved overnight, but with consistent effort, smart policies, and innovative approaches, Connecticut can build a future where everyone has access to safe, affordable housing. And honestly, isn’t that the kind of future worth working toward?