Introduction

Let’s be honest – running a business can feel like you’re constantly juggling flaming torches while riding a unicycle. One minute everything’s smooth sailing, and the next minute your main equipment decides to call it quits, or that big client who promised to pay “next week” suddenly goes radio silent for a month.

Sound familiar? Well, you’re definitely not alone.

This is where same day funding business loans come into play. Think of them as the superhero of the business world – they swoop in when you need cash yesterday and can actually deliver funds to your bank account within 24 hours. Sometimes even faster than your favorite pizza place!

Now, before you get too excited, let me tell you what these loans really are. Same day funding business loans are basically financing options designed for businesses that can’t wait around for traditional banks to get their act together (which, let’s face it, can take forever). We’re talking about online lenders who’ve figured out how to cut through all the red tape and get you money fast – like, really fast.

Here’s why this stuff matters: Remember the last time you applied for a loan at your local bank? The paperwork probably looked like it was written in ancient hieroglyphics, and they wanted to know everything from your third-grade report card to your grandmother’s maiden name. Meanwhile, your business is bleeding money while you wait weeks for an answer.

This guide won’t sugarcoat anything. I’ll walk you through how these loans actually work, what they’ll cost you (spoiler: it’s not cheap), and whether they’re worth it for your situation. By the time you’re done reading, you’ll know if same day funding business loans are your business’s new best friend or just an expensive Band-Aid.

What Defines a “Same-Day Business Loan”?

Alright, so what exactly counts as a “same-day” loan? It’s not as straightforward as you might think, and trust me, some lenders get pretty creative with their definitions.

At its core, a same-day business loan is any financing that can get money into your business account within 24 hours of getting approved. Some lenders are even faster – I’m talking funds hitting your account in just a few hours. It’s like ordering takeout, but instead of pad thai, you get cash.

Here’s what makes these loans different from your grandpa’s bank loan:

They’re digital-first. Everything happens online – applications, document uploads, approvals, the works. No sitting in stuffy bank offices making small talk with loan officers who look like they’d rather be anywhere else.

Minimal paperwork. Instead of bringing a wheelbarrow full of documents, you usually just need your basic financial statements and bank records. Revolutionary, right?

Relaxed requirements. Your credit doesn’t have to be perfect, and you don’t need to have been in business since the stone age to qualify.

Automated everything. These lenders use fancy algorithms to make decisions fast. No committee meetings or month-long deliberations.

Now, here’s where it gets a bit tricky. Some lenders say “same day” but really mean “same business day if you apply before 2 PM on a Tuesday when Mercury isn’t in retrograde.” Others are more flexible. Always ask about their actual timeline because “fast” is relative.

Why do businesses actually need this stuff?

Life happens, you know? Your cash flow might be humming along nicely until BAM – your biggest client decides they’re going to pay you “eventually,” your delivery truck breaks down, or you spot an amazing deal on inventory that you need to jump on TODAY.

These aren’t theoretical problems. I’ve seen businesses miss out on game-changing opportunities because they couldn’t access capital quickly enough. On the emergency funding wh, en traditional banks would’ve just shrugged and said, “Maybe next month.”

The bottom line? Same day funding business loans exist because the business world moves fast, and sometimes waiting for traditional financing is like trying to catch a taxi during rush hour while it’s raining – good luck with that.

Types of Same-Day Business Loan Options

Okay, here’s where things get interesting. Not all fast money is created equal, and understanding your options can save you from making expensive mistakes. Let me break down the main players in the same-day funding game:

| Type | What You’ll Pay | How Long | How Much | What They Want | Best For |

|---|---|---|---|---|---|

| Business Line of Credit | 7-25% APR | Up to 2 years | Up to $250K | Sometimes collateral | When you need flexibility |

| Equipment Financing | 8-30% APR | 2-6 years | Equipment value | The equipment itself | Buying or upgrading gear |

| Invoice Factoring | 0.5-3% fee | Varies | Invoice amount | Your unpaid invoices | When customers pay slowly |

| Merchant Cash Advance | 20-150% effective APR | 3-18 months | Up to $250K | Daily card sales | If you process lots of credit cards |

| Short-Term Loans | 15-50% APR | 3-24 months | Up to $500K | Sometimes collateral | Quick cash for specific needs |

Let me give you the real scoop on each of these:

Business Lines of Credit are like having a business credit card’s cooler, more sophisticated cousin. You get approved for a certain amount, and you can use it whenever you need it. The best part? You only pay interest on what you actually use. It’s like having a financial safety net that doesn’t cost you anything until you need it.

The good: Super flexible, great for unpredictable expenses, and you can pay it back and use it again. The not-so-good: Interest rates can change, and if the economy gets wonky, your credit line might shrink faster than a cheap t-shirt in hot water.

Short-term loans are the straightforward option. You borrow X amount, you pay back X plus interest over a set period. Simple, predictable, no surprises. These work great when you know exactly how much you need and can handle fixed monthly payments.

Merchant Cash Advances (MCAs) – oh boy, where do I start? These are like the fast food of business financing. Quick, convenient, but definitely not the healthiest choice for your financial diet.

Here’s how they work: A lender gives you a lump sum, and in return, they take a percentage of your daily credit card sales until you’ve paid back the total amount. Sounds reasonable, right? Well, here’s the catch – they use something called “factor rates” instead of traditional interest rates.

A factor rate of 1.3 means you pay back $1.30 for every dollar you borrow. Doesn’t sound too bad until you realize you’re paying that back over just a few months, which can work out to an effective APR that’ll make your eyes water. I’m talking potentially 100-200% annual rates. Yikes.

The good: Lightning-fast funding, minimal requirements, automatic payments. The bad: Expensive as heck, daily payments can mess with your cash flow, and early payoff usually doesn’t save you money.

Invoice Factoring is pretty clever if you think about it. You have invoices that customers will pay… eventually. A factoring company buys those invoices from you for 70-90% of their value upfront. It’s like selling your future money for today’s money.

This works great if you’re tired of waiting 30, 60, or 90 days to get paid. The factoring company deals with collecting from your customers, and you get cash now. Just remember – you’re essentially paying a premium for not having to wait.

Equipment Financing is probably the most logical of the bunch. Need a new truck? New machinery? The lender buys it, and you make payments. The equipment serves as collateral, which usually means better rates than unsecured options.

Business Credit Cards deserve a mention, too. Many offer instant approval, and some have those sweet promotional 0% APR periods. For smaller amounts or short-term needs, they can be way cheaper than other same-day options.

The key thing to remember? Each option has its place, but none of them are free money. Choose based on your specific situation, not just what’s fastest or easiest to get approved for.

Eligibility and Qualification for Same-Day Funding

Let’s talk about what it actually takes to get approved for same day funding business loans. The good news? These lenders are way more chill than traditional banks. The less good news? They still want to know you can pay them back.

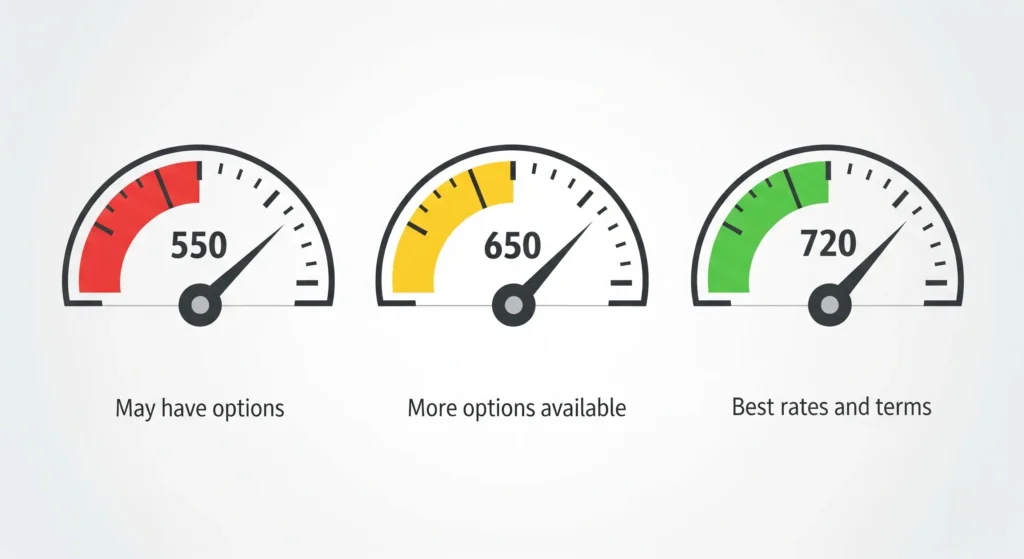

Credit Scores – Not as Scary as You Think

Here’s something that might surprise you: your credit doesn’t have to be perfect. In fact, it doesn’t even have to be good by traditional standards.

- Merchant cash advances: Some will work with credit scores as low as 500. That’s like getting into college with a D+ average.

- Online term loans: Usually want to see at least 550-625. Still pretty forgiving.

- Lines of credit: These guys are a bit pickier, typically wanting 600+.

- Equipment financing: Often flexible since they have the equipment as backup.

Now, don’t get me wrong – having better credit will get you better rates and terms. But if your credit took a beating during that rough patch a couple of years ago, you’re not automatically out of luck.

Time in Business – They’re Not Looking for Dinosaurs

Most lenders want to see that you’ve been in business for at least 6-12 months. That’s it. You don’t need to be the next McDonald’s or have been around since your great-grandfather’s time.

Some merchant cash advance providers are even more relaxed – they might work with businesses that have been processing credit cards for just 3 months. Equipment lenders might be flexible too, since they’ve got the gear as collateral.

If you’ve been in business for 2+ years, you’re golden and will probably get better offers. But if you’re newer, don’t give up – options exist.

Revenue Requirements – Show Me the Money

This is where lenders really pay attention. They want to see that money is coming in regularly because, well, that’s how you’re going to pay them back.

Typical requirements:

- Monthly revenue: Usually $10K-$25K minimum

- Annual revenue: Often $100K-$250K depending on the lender

- Consistency: They like to see stable or growing income, not a roller coaster

The cool thing is they’re looking at your recent bank statements to verify this, so if you had a rough year but things have picked up recently, that works in your favor.

Documentation – Way Less Painful Than You’d Expect

Remember those horror stories about bringing three boxes of paperwork to the bank? Yeah, forget about that. Here’s what you typically need:

- Bank statements: Usually 3-6 months worth

- Tax returns: Last 1-2 years for established businesses

- Business license: Proof you’re legit

- ID: Driver’s license or passport

- Voided check: So they know where to send the money

That’s it. Most of this stuff you probably have sitting in a folder somewhere already.

The Personal Guarantee Thing

Here’s something important: while most same-day loans don’t require collateral (like your house or car), they usually do want a personal guarantee. This basically means if your business can’t pay, you’re on the hook personally.

It sounds scarier than it usually is in practice, but it’s something to be aware of. Equipment financing is different since the equipment itself is the collateral.

Pro tip: Be honest on your application. These lenders use automated systems that can verify a lot of what you tell them through your bank account anyway. Fudging numbers will just slow things down or get you rejected.

The Streamlined Application Process for Instant Approval

Alright, let’s walk through how to actually get one of these loans. The good news is it’s way simpler than traditional lending. The better news is you can do it in your pajamas with a cup of coffee.

Step 1: Get Your Financial House in Order. Before you start clicking “apply now” on every lender’s website, take a step back and figure out what you’re dealing with. Pull your credit report (it’s free, and you should be doing this regularly anyway), look at your bank statements, and be honest about how much debt your business can actually handle.

This isn’t just busy work – it prevents you from borrowing too much or applying to lenders who aren’t a good fit. Plus, it shows you where you stand financially, which can be eye-opening in both good and bad ways.

Step 2: Shop Around (Yes, Really) I know you’re probably in a hurry, but spending an hour comparing options can save you thousands of dollars. Make a list of 3-5 lenders that seem like they’d work with businesses like yours.

Pay attention to the total cost, not just the interest rate. A loan with a lower rate but higher fees might cost more overall. Also, read reviews – if a lender has a bunch of complaints about hidden fees or terrible customer service, keep looking.

Step 3: Pick Your Lender Look for lenders who are transparent about their terms and fees. Red flags include anyone who:

- Wants money upfront before approving you

- Won’t give you clear information about costs

- Pressures you to sign RIGHT NOW without time to review

- Has terrible reviews or sketchy contact information

Trust your gut here. If something feels off, it probably is.

Step 4: Fill Out the Application. Most applications take 10-30 minutes and ask pretty straightforward questions:

- Basic business info (name, address, how long you’ve been in business)

- What industry you’re in

- How much revenue you make monthly and annually

- How much you want to borrow and what for

- Your personal info since you’ll likely be guaranteeing the loan

Be honest and accurate. The automated systems will catch inconsistencies, and lying will just waste everyone’s time.

Step 5: Upload Your Documents. Remember that simple list from earlier? Upload those documents through their secure portal. Make sure everything is readable and recent. Some lenders can connect directly to your bank account to pull statements automatically (with your permission), which speeds things up.

Step 6: Wait (But Not for Long) Most lenders will give you a decision within a few hours to 24 hours. If approved, funds typically hit your account the same day or next business day.

Pro tips for faster processing:

- Apply early in the day (before noon) for same-day funding

- Have all your documents ready before you start

- Respond quickly if they ask for anything additional

- Apply Monday-Thursday for the best chance of same-day funding (weekends and Fridays can push funding to the next week)

The whole process is designed to be fast and relatively painless. Most business owners are surprised by how much easier it is compared to traditional bank loans.

Pros and Cons of Same-Day Business Loans: The Real Talk

Okay, let’s get real about same day funding business loans. They’re not magic money fairies, and they’re definitely not free. Here’s the honest breakdown of what you’re getting into.

The Good Stuff:

Speed is the obvious winner here. When your main delivery truck breaks down and you’ve got orders to fulfill, waiting three weeks for a bank loan isn’t exactly helpful. Same-day funding can literally save your business in these situations.

They’re surprisingly accessible. Remember how banks used to make you feel like you were asking for a kidney donation? These lenders actually want to work with you. Bad credit? They’ll probably still talk to you. New business? There are options. It’s refreshing, honestly.

The process doesn’t make you want to pull your hair out. Everything’s online, the applications make sense, and you’re not drowning in paperwork. You can apply during your lunch break and potentially have an answer before dinner.

You can actually use the money however you need to. No explaining to some loan committee why you need exactly $15,000 for inventory when your business plan said $12,000. If you qualify for the amount, it’s your money to use strategically.

The Not-So-Good Stuff:

Let’s talk about the elephant in the room: cost. These loans are expensive. Sometimes really expensive. We’re talking interest rates that can make your traditional banker faint. Some merchant cash advances work out to effective APRs over 100%. That’s not a typo.

Short repayment terms can be brutal. While your bank might give you 5 years to pay back a loan, same-day options often want their money back in 3-24 months. Some merchant cash advances take a cut of your daily sales, which can seriously mess with your cash flow.

The debt cycle trap is real. If you’re using expensive short-term money to solve long-term problems, you might find yourself borrowing again and again. It’s like using a credit card to pay another credit card – it works short-term but can spiral quickly.

Your future financing options might suffer. High-cost debt can strain your cash flow, making it harder to qualify for better loans later. Plus, some lenders restrict you from getting other financing while their loan is active.

They might not help build your business credit. Unlike traditional bank relationships that can improve your credit profile, some of these lenders don’t report positive payment history. Missed opportunity there.

The truth: Same-day loans are like emergency room visits. When you really need them, they’re lifesavers and worth every penny. But you wouldn’t want to rely on the ER for routine healthcare, and you don’t want expensive emergency funding to become your regular financing strategy.

Understanding the Costs of Same-Day Business Loans

Let’s talk money – specifically, how much these loans actually cost you. This is where things can get a bit tricky because lenders don’t always make it easy to understand the real price tag.

Interest Rates and How They Really Work

Some lenders use traditional APRs (annual percentage rates), which is what you’re used to seeing. For same-day options, these typically range from 15% to 50%, which is already higher than most traditional loans.

But here’s where it gets interesting: many same-day lenders use something called “factor rates” instead. This is especially common with merchant cash advances.

Here’s how factor rates work: Let’s say you borrow $20,000 with a 1.4 factor rate. You’ll pay back $28,000 total ($20,000 × 1.4). Sounds straightforward, right?

The problem is, you’re not paying that back over a year – you might be paying it back over 6 months. When you convert that to an annual percentage rate, you could be looking at 80-120% APR. Ouch.

The Fee Parade

Interest isn’t the only cost. Oh no, that would be too simple. Here are some fees you might encounter:

- Origination fees: 1-5% of your loan amount right off the top

- Processing fees: A few hundred bucks for the privilege of applying

- Documentation fees: Because apparently scanning your tax return is expensive

- Draw fees: Some lines of credit charge you $50-100 every time you access funds

- Late payment fees: Miss a payment and pay anywhere from $25 to several hundred dollars

These fees add up fast and can significantly increase your total borrowing cost.

Real-World Cost Examples

Let me give you some examples that might make your eyes water:

Scenario 1: $30,000 merchant cash advance with a 1.3 factor rate

- Total repayment: $39,000

- If paid back over 8 months: roughly 45% effective APR

- Add a 2% origination fee: another $600

- Total cost: $9,600 on a $30,000 advance

Scenario 2: $30,000 traditional bank loan at 8% APR over 3 years

- Total interest: about $3,800

- Difference: $5,800 more for the same-day option

How Credit Affects Your Costs

Your credit score is like a discount card – the better your score, the better your rates:

- Excellent credit (720+): You’ll get the best rates available

- Good credit (650-719): Decent rates, reasonable terms

- Fair credit (600-649): Higher rates, stricter terms

- Poor credit (below 600): Highest rates, shortest terms, smallest amounts

The difference between excellent and poor credit can be 10-20 percentage points or more in your favor.

Ways to Keep Costs Down

- Borrow only what you actually need: Every extra dollar borrowed costs you more

- Pay back early if there’s no penalty: Some lenders offer savings for early repayment

- Compare total costs, not just rates: Look at the complete picture including all fees

- Consider your timing: If you can wait even a few days, you might find cheaper options

The bottom line? Same day funding business loans are expensive, but sometimes the speed and convenience justify the cost. The key is understanding exactly what you’re paying for and making sure it’s worth it for your specific situation.

Alternatives to Same-Day Business Loans

Before you commit to expensive same-day funding, let’s explore some other options that might work for your situation. Sometimes, slowing down just a little bit can save you thousands of dollars.

SBA Loans: The Gold Standard (If You Can Wait)

SBA loans are like the wise, patient grandparent of business financing. They offer amazing rates (often 6-12% APR), long repayment terms (up to 25 years for some loans), and no prepayment penalties.

The catch? They take forever. We’re talking 30-120 days typically. The paperwork is extensive, the requirements are strict, and the process can make watching paint dry seem exciting.

But if you can plan ahead and don’t need money immediately, SBA loans can save you a fortune compared to same-day options.

Business Bridge Loans: The Middle Ground

Think of bridge loans as the compromise between SBA loans and same-day funding. They typically fund within 2-10 business days and are designed to “bridge” gaps while you wait for other funding or payments.

These work great when you know money is coming (like a big contract payment or a pending real estate deal), but you need cash now to keep things moving. Interest rates are higher than traditional loans but usually lower than same-day options.

SBA Microloans: For Smaller Amounts

These are SBA’s attempt at being more accessible. Microloans go up to $50,000, have more flexible requirements, and typically fund within 2-4 weeks. They’re perfect for newer businesses or smaller financing needs.

Peer-to-Peer Lending: Cut Out the Bank

Platforms like Funding Circle connect you directly with investors. It’s like Kickstarter for business loans. The process is usually faster than traditional banks (1-2 weeks), and rates are often competitive.

Revenue-Based Financing: Pay as You Earn

This is pretty cool – you get money upfront and pay back a percentage of your monthly revenue until you’ve paid a predetermined amount. If your revenue goes down, your payments go down too. If business is booming, you pay more.

It’s great for businesses with predictable but variable revenue. The lender cares more about your sales trends than your credit score.

Business Credit Cards: Don’t Overlook the Obvious

Many business credit cards offer instant approval and some have promotional rates (0% for 12-18 months for new cardholders). For smaller amounts or short-term needs, this can be way cheaper than other same-day options.

Plus, you’re building business credit and might earn rewards.

Equipment Leasing vs. Buying

If you need equipment, consider leasing instead of buying with a loan. Monthly payments are often lower, you can upgrade more easily, and you don’t tie up capital in depreciating assets.

Personal Options (for Smaller Amounts)

Sometimes personal loans, home equity lines of credit, or even borrowing from your 401(k) can be cheaper alternatives for smaller business needs. Just be careful about mixing personal and business finances.

Get Creative with Vendor Terms

Before borrowing money to buy inventory or services, try negotiating better payment terms with your suppliers. Many vendors prefer guaranteed payment in 60 days over losing a sale.

The Bottom Line

Even when you’re in a hurry, it’s worth spending an hour exploring alternatives. The difference in cost between same-day funding and waiting just a few extra days can be substantial. Sometimes the “emergency” isn’t as urgent as it feels in the moment.

Frequently Asked Questions (FAQs) About Same-Day Business Loans

Let me answer the questions I get all the time about same day funding business loans. These are the real concerns business owners have, not the fluff you’ll find on most lender websites.

How long do I need to be in business to qualify? Most lenders want to see 6-12 months of operation, though some merchant cash advance providers might work with businesses that have just 3 months of credit card processing history. If you’re brand new, you might need to look at personal loans or SBA microloans instead.

The longer you’ve been in business, the better your options and rates will be. Two years seems to be the sweet spot where lenders start offering their best terms.

What if my credit is terrible – like really bad? Here’s some good news: many same-day lenders specialize in working with businesses that have credit challenges. I’ve seen approvals for credit scores in the 500s, which would get you laughed out of most traditional banks.

The trade-off is higher interest rates and less favorable terms. But if you need the money and can handle the payments, bad credit doesn’t automatically disqualify you.

Do I have to put up my house or car as collateral? Most same day funding business loans are unsecured, meaning no collateral required. However, almost all of them will want a personal guarantee, which makes you personally responsible if the business can’t pay.

Equipment financing is different – the equipment itself serves as collateral. Some larger loans might require business assets like inventory or receivables as collateral.

Can I get funded on weekends? You can apply 24/7, but funding typically only happens on business days. If you apply on Friday afternoon, you probably won’t see money until Monday. Some lenders have cutoff times (like 2 PM) for same-day consideration.

Pro tip: Apply early in the week and early in the day for the fastest funding.

What happens if I can’t make a payment? This is where things can get ugly fast. You’ll face late fees (often $25-100+ per missed payment), potential damage to your credit score, and aggressive collection efforts.

If you think you might miss a payment, call your lender immediately. Some are willing to work with you on payment plans or modifications, but you need to be proactive about it.

How do these rates compare to business credit cards? Same day funding business loans, especially merchant cash advances, are often more expensive than business credit cards. Cards typically charge 15-25% APR, while same-day loans can be 50-150%+ in effective annual cost.

However, credit cards have lower limits and might not give you the lump sum you need. For promotional 0% APR periods, cards can be much cheaper for short-term needs.

Are SBA loans fast funding? Definitely not. SBA loans are the opposite of fast – they typically take 1-4 months to process. They’re great for long-term planning but useless for urgent needs.

What industries can’t get these loans? Most industries can qualify, but some face restrictions: gambling, adult entertainment, crypto businesses, and some high-risk sectors often get rejected. Each lender has their own list of preferred and restricted industries.

Can I have multiple same-day loans at once? Technically possible, but usually not a good idea. Multiple high-cost loans can create a dangerous debt spiral that’s hard to escape. Some lenders also restrict additional borrowing while their loan is outstanding.

If you need more money, consider whether refinancing or consolidating might be a better approach.

What’s the biggest mistake businesses make with these loans? Using expensive short-term money to solve long-term problems. If your business has fundamental cash flow issues, a merchant cash advance isn’t going to fix them – it might make them worse.

These loans work best for true emergencies or time-sensitive opportunities, not ongoing operational shortfalls.

Conclusion: Making an Informed Decision

So here we are at the end of our journey through the wild world of same day funding business loans. Let me give you the real talk summary.

These loans are like that friend who’ll lend you money at 2 AM when you’re stranded – incredibly helpful when you really need them, but you probably shouldn’t make it a regular thing.

When same-day funding makes sense:

You’re facing a genuine emergency that could seriously damage your business if not addressed immediately. Your main equipment broke, and you’ll lose customers if you can’t fix it today. There’s a time-sensitive opportunity that could significantly benefit your business. You have temporary cash flow issues, but expect payments soon.

When you should probably look elsewhere:

You’re trying to solve ongoing cash flow problems (these loans might make them worse). You can realistically wait a few days or weeks for cheaper financing. You’re not confident about your ability to handle the high payments. The opportunity isn’t as time-sensitive as it feels in the moment.

My honest recommendation: Treat same-day loans like emergency medicine – powerful when you need them, but not something you want to rely on regularly. The high costs are the price you pay for speed and convenience.

If you do decide to go this route, shop around, read the fine print, and make sure you have a solid plan for repayment. Don’t just focus on getting approved – focus on making sure the loan actually helps your business rather than creating new problems.

The key things to remember:

- These loans are expensive, but sometimes speed justifies the cost

- Shop around and compare total costs, not just rates

- Be honest about your ability to repay

- Choose reputable lenders with transparent terms

- Have a plan for how this loan fits into your broader business strategy

Most importantly, use this financing as a bridge to better options, not as a permanent solution. Work on building business credit, establishing banking relationships, and creating cash reserves so you’re not dependent on expensive emergency funding.

Your business deserves the best financing options available, and sometimes that means being patient and strategic rather than just fast.

Call to Action

Ready to explore your options? Whether you’re dealing with an immediate need or want to be prepared for future opportunities, taking action now can make all the difference.

If you need funding urgently, start by getting your financial documents organized (bank statements, tax returns, ID). Research 3-5 reputable lenders that work with businesses like yours. Apply early in the day on a weekday for the best chance of same-day funding.

If you’re planning: This is actually the perfect time to set up financing relationships before you need them. Consider applying for a business line of credit that you can use when opportunities arise. Build relationships with multiple lenders so you have options when speed matters.

Want to avoid expensive emergency funding altogether? Start building business credit, establish a relationship with a local bank, and consider setting aside cash reserves for unexpected situations. Sometimes the best emergency loan is the one you never need to take.

Connect with funding experts who can help you navigate your options and create a financing strategy that makes sense for your business. Many offer free consultations and can save you time and money by pointing you toward the right solutions.

The bottom line: Your business’s success often depends on having access to capital when you need it most. Whether that’s same day funding business loans or other options, being informed and prepared gives you the best chance of making smart financial decisions when it matters most.

Don’t wait until you’re in crisis mode to understand your options. Take some time now to research, prepare, and position your business for financial success. Your future self will thank you.